Trading 4 Noobs

Trading with ICT signatures & Time principles

A convenient and Webflow friendly patch for the Lenis Smooth Scroll library.

Context

Interest rates - cost of borrowing or reward for saving

Yield ∝ Currency Price

Lower bond price

Buy side - upwards|higher pricing

Sell side - downwards|lower pricing

Trend - direction in which price is presently moving

AAA - Most confident trading opportunity

Open float – refers to the open interest within the market,

the side liquidity is being drawn to

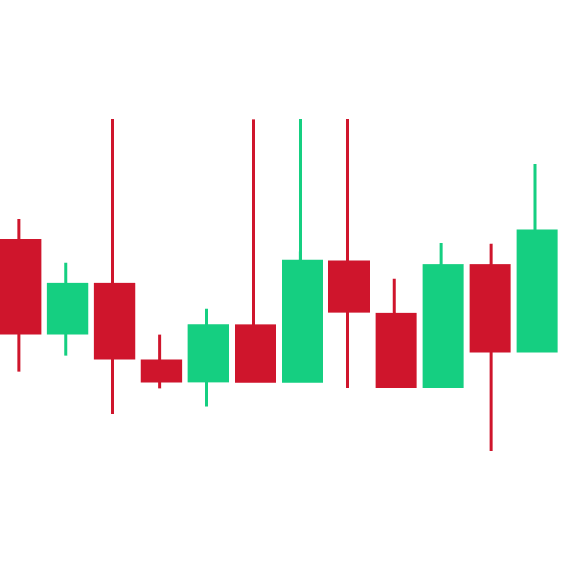

Turtle soup - when a candle prints then quickly shortens leaving behind a wick of length - if in favour of draw on liquidity, these can be confirmation to enter the market

FUD - Information shared with the intent to push pice down

FOMO - Information shared with the intent to push price up

PIP - price interest point - the smallest whole unit price move, the integer after the fourth decimal place

EUR/USD- 1.13215

USD/JPY - 113.215

OLHC - open low high close - what we expect from a bullish candle formation [daily candle - low in london open, high in new york]

OHLC - open high low close - what we expect from a bearish candle formation [daily candle - high in london open, low in new york]

LOT - 1 lot = 100,000 units of a currency

What is the market and how is price delivered?

The market is orchetrated by an algorithm which seeks to deliver liquidity buy side to sell side confirming price action and rebalancing imbalances in price delivery offering a 'fair entry' for everyone in the market

Who owns the currency?

Central Banks [not JP Morgan, not HSBC] - Bank of America, Bank of England...

Market

physical, digital, virtual, official, financial, and commercial

embracing economical competition, harnessing algorithmic price delivery

Goals & Risk

What is your goal?

What specific finncial objectives do you aim to achieve through trading?

Are your goals focused on short-term gains, long-term investments, or a combination of both?

How do you priorotise your financial goals personally, and are they alined with your overall plan?

How comfortable are you wth delayed gratification and short-tem losses in pursuit of long-term gains?

What is your trading objective?

Are you looking to capture an instantaneous movement in price?

Are you aiming to take advantage of prevoius price action to fall in line with present price delivery?

Are you looking to find a suitable entry to move with the market and capitulate on a prie leg?

What is your risk association?

Have you experienced and assessed your emotional response to fnancial losses [ context assessment ]?

What is your desired profit target for a trade, does it align with your trading objective [ realism assessment ]?

What is the % of your capital/liquidity you are open to willingly lose on a single trade [ tolerance assessment ]?

Are you aware you must periodically assess your risk exposure basd on your trading objective in relation to current market conditions [ reflection assessment ]?

Time principles

Entry: 1H -> 15min

Entry: 5min -> 1min

Entry: 3min -> 1min

On th HTF, is price moving towards buyside, sellside, or accumuating?

Dropping one timeframe, where has the preset trend began?

Dropping one timeframe again, range from the end of the previous trend [ previous high|low ] to the start of the present, and mark halfway [ consequent enroachment|50%.

Is price below this mark [ discount ], above [ premium ], or near to [ATO]?

Dropping one timeframe, is there a local high/low|top/bottom or opposing price signature [ DOL ], that if priced through favours continuation of the present trend?

Dropping one timeframe, await the formation of a price signature in direction of continuation.

Does pricing through the DOL lead into a HTF price signature? [ AAA ]

ICT Signatures

.png)

.png)

Economics

ratesReward for saving|Cost of borrowing

What is the market & how is price delivered?

The market is predetermined and monitored by an algorithm which seeks to confirm price action. This is achieved by delivering liquidity buy side to sell side to rebalance imbalances/inefficiencies and offer fair entry for new liquidity.

The market is owned by no-one, currency is owned by central banks.

How does the Monatery Policy Committee combact inflation?

When the MPC think that inflation is due to consumer spending being too high, they will increase rates to reduce spending on credit, and finance to cool down the economy thus bringing rates down.

Quantitative Easing - where a central bank purchases predetermined amounts of government bonds in order to stimulate economic activity, increasing bond rices,decreasing yields thus decreasing interest rates

Quantitative Tightening - where a central bank sells predetermined amounts of government bonds in order to reduce economic activity, decreasing bond rices, increasing yields thus increasing interest rates

MMXM

Approaching Trading

something that comes with practice and time

For a bullish week:

Monday or Tuesday will usually make thelow of the week, then the high will be made towards the end of the week to allow for expansion in the candle.

Thursday will usually make the high of the week, unless there is a high impact new event on Friday, in which case the high will most likely be made on this day.

For a bullish day:

The low will be put in as the day opens, within london open session [7am-10am] UK

The high will be made later on in the day, within new york open session[12pm-3pm] UK

When anticipating a bullish week, we are looking to only entertain buying opportunities in our daily candle.

- a run below midnight price

- respect shown to a bullish signature, or rejection off a bearish, forming the day low: OLHC theory (open low)

- a clear draw on liquidity

- clear internal liquidity to favour that draw on liquidity being priced through

- a formation of a bullish price signature

- a low to be made early on in the session, usually before the first hour of opening

This is offset accumulation ( the pairing of retail shorts with market money longs) - running sell side liquidity to then be used to fuel the move to buy side

Offest distribution - the pairing retail longs with market maker money shorts

- alignment with continuation (if no alignment with trend leaving london open, new york could possibly offer trend reversal)

- a clear draw on liquidity

- formation of a bullish signature to then move to put in the day high : OLHC theory (close high)

Building your bias before the week opens eliminates 50% of the possibility of being incorrect in your investment/trading decision during that week

bias is formed from the HTF (the 1 week), as on a larger scale the market prints in favour of where the monthly candles are heading

it may not be clear before the week opens where the market may head during that week, if so simply allow for Monday's daily candle to print, the form a bias around this

In situations where it is still unclear after marking areas of liquidity, the true investor waits for price to fall in line with time, and simply reapproaches the market the next trading day to search for opportunity again

Waiting for price to fall in line with time could have you studying the market for a whole session, and only being greeted with a window of opportunity as it looks to end

The paradox here is if no clear black and white opportunity appearsin the market aliging with your bias, simply close the day

Risk is a measure of the failure of judgement not the possibility of suffering a financial loss

To begin developing bias:

open the chart, switch to the weekly, head back in time (tradingview premium required), and note down whether you think the week will close higher or lower than the previous

Rinse and repeat until you are becoming more accurate in predicting

Now begin profiling, noting which day puts in the low of the week and which day puts in the high

Then do these steps again for the daily, noting which session puts in the low of the day and which puts in the high

Practice these steps for as much timeframe time as you can to better build your judgement

Trading

after the upwards displacing candle

to the low of the HTF FVG

with stoploss below the low of the price signature

[ visually a few candlesticks ]

.png)